Introduction

Learn how to set up tax settings for your Google Merchant Center account to avoid suspension or reactivate your account after it has been suspended. Setting up sales tax identical to settings within your store is critical as a mismatch can lead to a suspension of your account as a result hurting your business.

What is the difference between tax settings for Google Merchant Center and for Google Ads?

There are several differences between Google Ads tax settings and Google Shopping tax settings.

- Google Shopping tax settings are essentially the sales tax that you would charge your clients that are located in a state where you are obligated to charge sales tax.

- Google Ads tax settings are your company’s tax information or personal tax information that Google requires to report activity within your account to IRS.

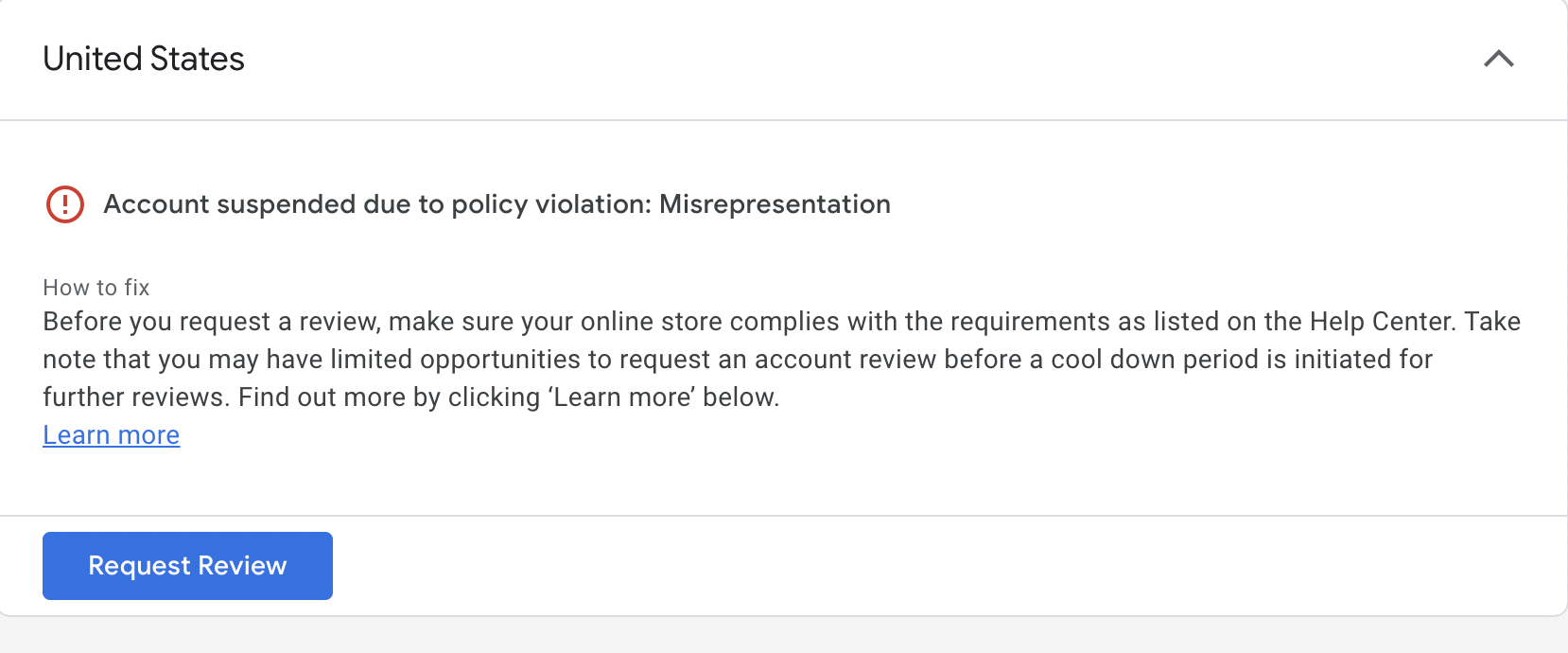

How do I know if my account is suspended?

If your account has been suspended, you will receive an email notification from Google similar to the screenshot above. Meaning, you will not be able to advertise your products on Google and you have to address the issue as soon as possible. The suspension will not be lifted until sales tax information within Google Merchant Center matches that on your store.

What happens next?

Once your account has been suspended, you will not be able to publish products or access the tax settings page.

If you have any questions about this process, please contact us at [email protected].

How do I fix it?

If you are experiencing this issue, there are a few things you can do to resolve it.

- Make sure that your tax settings are correct. If they’re not, that could cause the suspension.

- Check on the rates and zones in which you sell products or services in order to make sure they match up with what Google expects from their merchant center account holder.

- Consider whether any exemptions may apply based on where your business operates (i.e., if it’s registered in different states).

How do I setup tax settings?

To review your tax settings, click on the [Account] tab and then select [Tax Settings].

- Check that you’re using the correct tax settings. If you’re not sure what to do, contact your account manager or write in to support@google.com for help!

- Make sure that taxes are set at the product level and not campaign level (or vice versa). This is especially important if you have multiple products with different prices but similar descriptions; if taxes are applied at campaign level instead of product level then all those items will be taxed equally regardless of their actual value.

- Check whether or not you have any ads running which target countries where there is no sales tax charged, such as Australia or New Zealand; these should have zero percent applied unless otherwise specified by law

Where can I find more information about taxes and state sales tax rates?

If you have more questions about taxes and state sales tax rates, please visit the following websites:

- https://www.salestax.com/ – A site that provides information about how to collect sales tax on Amazon.

- https://www.taxjar.com/ – A site that provides information on collecting taxes in eCommerce stores like Shopify or WooCommerce (and also has a calculator).

If you are unable to publish products, make sure that your tax settings are correct

- Check that you have the correct tax settings for your products:

- Check that the product category is set to “exempt” or “taxable.”

Conclusion

In conclusion, it is important to know how to set up your tax settings. If you are having trouble, please contact us so we can help! Check out our other articles and educate yourself on how to un-suspend your Google Merchant Center account.